san antonio property tax rate 2020

This is the total of. San antonio property tax rate 2020 Monday June 13 2022 Edit.

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

180767218 of Total 2019-2020 Budgeted Expenditures.

. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. Property Tax Rate The property tax rate for the City of San Antonio consists of two components. The Commissioners Court also voted Tuesday to approve the proposed tax rate of 0301097 per 100 of valuation.

Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. Skip to Main Content. The minimum combined 2020 sales tax rate for San Antonio Texas is 825.

8 meeting council members eventually approved by the. The minimum combined 2022 sales tax rate for San Antonio Texas is. The Texas sales tax rate is currently.

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket 2 2 Wichita Appraisal District How To Protest Property Taxes 2. Thereafter interest will continue to be added at the rate of 1 per month until the tax is paid. San Antonio TX 78238 P.

The no-new-revenue tax rate would Impose the same amount of taxes as. 666 Richfield Dr Windcrest See all homes for sale in Windcrest here Shavano Park. Example - Penalty and interest will be added at a rate of 7 for February 2 per month for March through June and 3 for July.

Balanced without property tax increase. The latest sales tax rate for San Antonio TX. 212 of home value Yearly median tax in Bexar County The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100.

In San Antonio. We update this information along with the city county and special district rates and levies by August. The December 2020 total local sales tax rate was also 8.

Estimated Tax Collection Rate. It took six votes and nearly two hours of debate but the city of Schertz has almost settled on a new tax rate. Ad Discover Hidden Info That Might Affect the Value of a Property.

Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. Find Mortgage Tax and Sale History Records for Millions of Homes Nationwide. Tax statements are then sent to all property owners.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. 2020 Official Tax Rates. The County sales tax rate is.

They are calculated based on the total property value and total revenue need. 48 rows Find the local property tax rates for San Antonio area cities towns school districts and Texas counties. The San Antonio sales tax rate is.

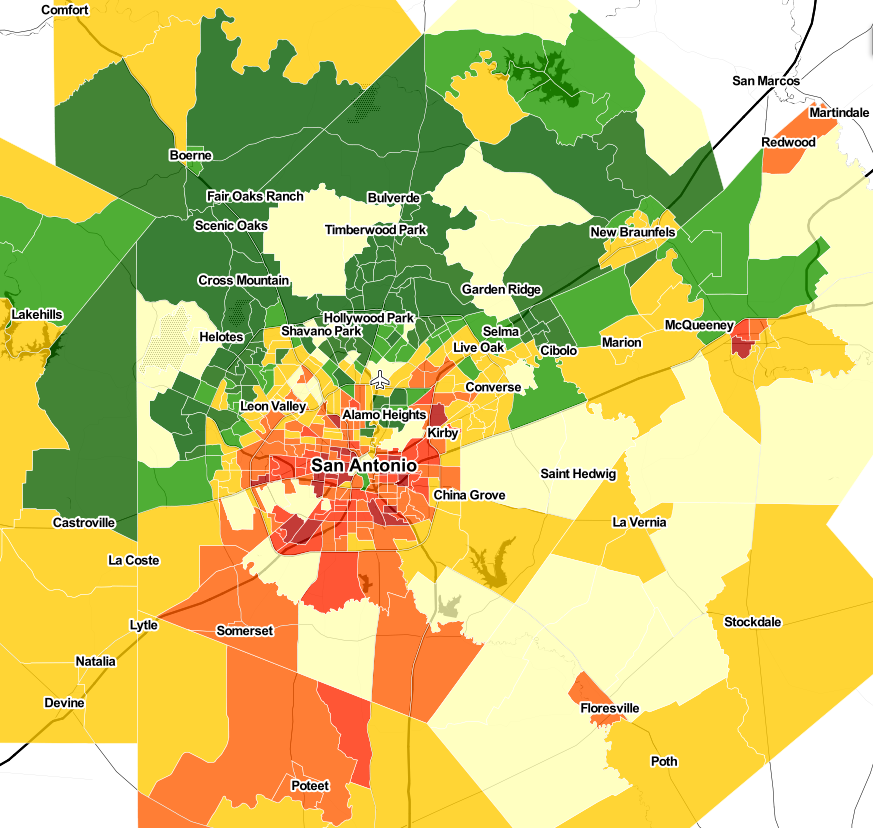

This rate includes any state county city and local sales taxes. China Grove which has a combined total rate of 172 percent has the lowest property tax rate in the San Antonio area and Poteet with a combined total rate of 322 percent has the highest rate in the area. The law caps property taxes at 35 unless voters approve an increase or a disaster triggers a rate increase to 8.

At a total rate of 242 per hundred dollars a home in Windcrest valued at the San Antonio average home price of 240000 would pay 580775- 64343 a year less than a homeowner paying San Antonio property taxes would pay if they owned the same home. Did South Dakota v. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

The tax rate is the same as the 2019-2020 fiscal year though the County estimates it will collect 159 million more in tax revenue compared with last year. The minimum combined 2020 sales tax rate for San Antonio Texas is 825. Before the new cap took effect.

What could this new law mean for San Antonio-area property owners in 2020. The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value. The City Council approved a 001 exemption of your homes value.

Should the current public health situation considered a disaster. Wayfair Inc affect Texas. It may seem like a drop in the bucket but Councilmen.

The property tax rate for the City of San Antonio consists of two components. Bexar County Texas Property Tax Go To Different County 248400 Avg. Largest expense is for public safety.

That means the city cashes in on 381 million property taxes. Unlimited Tax Debt Information Authorized Issued. Projected Undesignated Fund Balance as of August 31 2019.

We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb. Similarly you may ask how much are taxes in San Antonio. The tax rate varies from year to year depending on the countys needs.

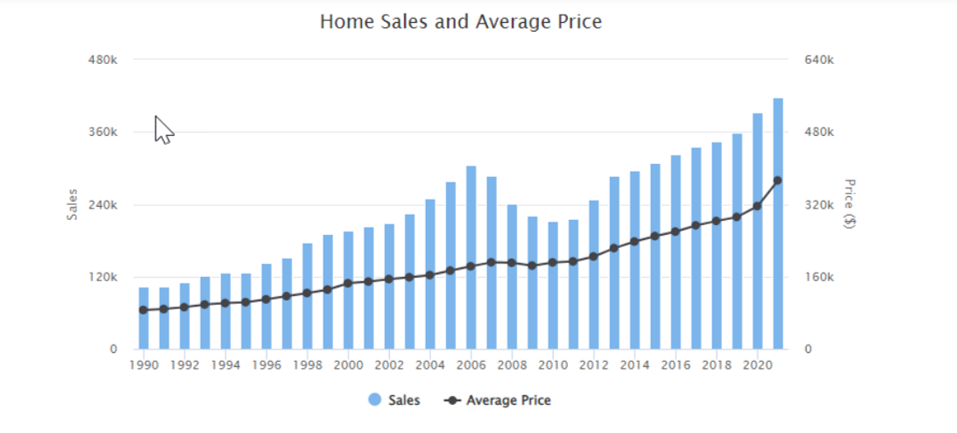

Homestead tax exemptions 100 disabled veterans pay no property tax in the state of Texas. San Antonio TX Sales Tax Rate. San antonio property tax rate 2020 Monday June 13 2022 Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact Tac School Property Taxes By County Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket San Antonio Real Estate Market Stats Trends For 2022.

This is the total of state county and city sales tax rates. The citys tax rate has been at nearly 056 since 2016. San Antonio TX 78207.

Its currently set at 556 cents per 100 of valuation and brings in 30 percent of the citys general fund revenue. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value.

The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable. The FY 2020 Budget keeps property tax rate at 55827 cents per 100 valuation. The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns.

Maintenance Operations MO and Debt Service. San Antonio was the last major Texas city to implement a homestead exemption. Bexar County collects on average 212 of a propertys assessed fair market value as property tax.

65 rows Discover what the 2020 tax rates and exemptions were. The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value. This is the.

Also to know how much are taxes in San Antonio. Instead it has been property. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

SAN ANTONIO -- The 2020 budget for the City of San Antonio is finally a done deal. Michael Amezquita chief appraiser for the Bexar County Appraisal District. What is the sales tax rate in San Antonio Texas.

The current total local sales tax rate in San Antonio TX is 8250. 2020 rates included for use while preparing your income tax deduction.

Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact

Sky High Property Appraisals Could Prompt A Higher Homestead Exemption For Sa Homeowners

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Texas Association Of Appraisal Districts Issues Guidance Brownwood News

Comal And Guadalupe Counties Approve Discretionary Tax Increase Measures Community Impact

Why Is El Paso S Property Tax Rate So High El Chuqueno

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Appraisal Animosity Fuels Push To Increase Homestead Exemptions In San Antonio Tpr

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Tac School Property Taxes By County

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill