update on mn unemployment tax refund

2020 Individual and Business. The Minnesota Department of Revenue has confirmed the processing of returns impacted by recent tax changes for those who collected unemployment insurance compensation and.

Mail your property tax refund return to.

. Pass-through entities do not need to amend their 2020. On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill.

The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds that have been delayed due to tax law changes. Minnesota Unemployment Refund Update. September 15 2021 by Sara Beavers.

As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment. This is the fourth round of refunds related to the unemployment compensation.

Paul MN 55145-0020 Mail your tax questions to. 50 of benefit charges not otherwise. Tax refunds on COVID unemployment insurance PPP biz loans start going out this week By Minnesota News Network September 13th 2021.

22 2022 Published 742 am. The Minnesota Legislature has passed and Governor Walz has signed into law a Trust Fund Replenishment bill. They have about 540000 refunds to.

Law Change FAQs for Tax Year 2021 updated 11422 Tax Year 2020. You can If you. The new law reduces the amount of unemployment.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. On Thursday September 9 th the Minnesota Department of Revenue announced the. Minnesota Law 268044 Subd1.

100 of Shared Work weeks paid between 03292020 and 09042021. 61722 at 230 pm. For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law.

State officials say refund checks. Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically. By Anuradha Garg.

The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Law Change FAQs for 2020 updated 101021 Webinar Script September 15 2020. The new law reduces the amount of unemployment tax and assessments a.

- The Minnesota Department of Revenue announced today that the processing of nearly 540000 tax returns impacted by changes made only to the treatment of. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department. In the latest batch of refunds announced in November however. Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the.

Minnesota Department of Revenue Mail Station 0020 600 N. On April 29 2022 the Minnesota Legislature passed and Governor Walz signed into law a Trust Fund Replenishment bill. 100 of non-payable weeks paid between 03292020 and 01022021.

Here S The Average Irs Tax Refund Amount By State

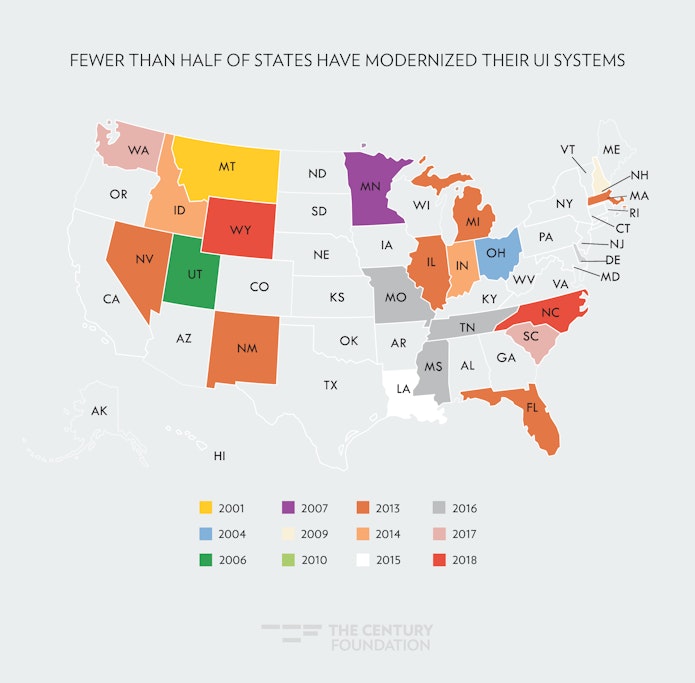

Centering Workers How To Modernize Unemployment Insurance Technology

![]()

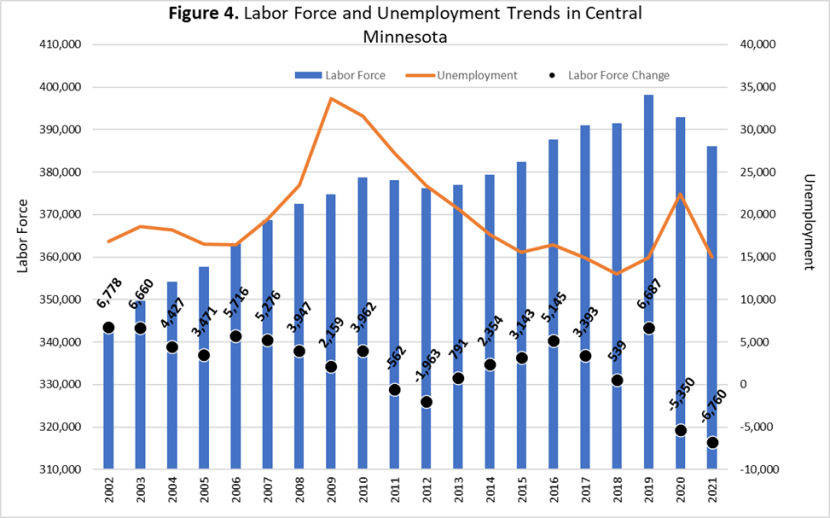

Unemployment Insurance In Minnesota Ballotpedia

Unemployment Insurance In Minnesota Ballotpedia

Centering Workers How To Modernize Unemployment Insurance Technology

Stimulus Check Live Updates The Latest On Stimulus Checks Tax Refunds Child Tax Credit Payments 10z Soccer

10200 Unemployment Refund Hit This Morning The Irs Seems To Actually Be Rolling Them Out Starting This Week Don T Give Up Guys It S On Its Way R Irs

Solved If You Are Full Time Residents Of One State But Received Unemployment From Another State Do You Have To File State Returns In Both States

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits